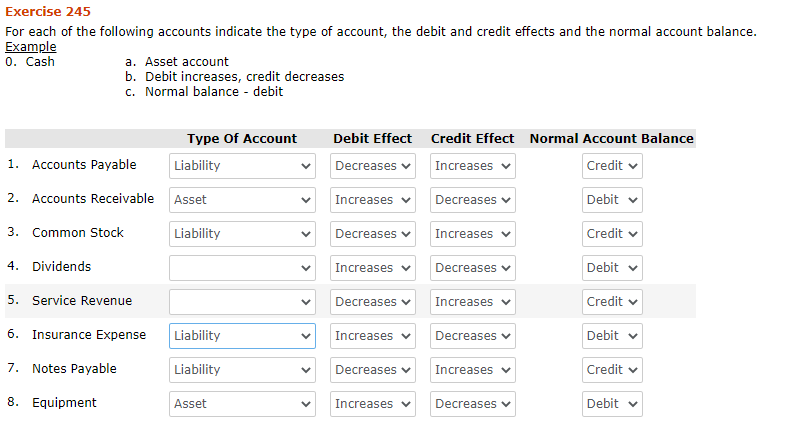

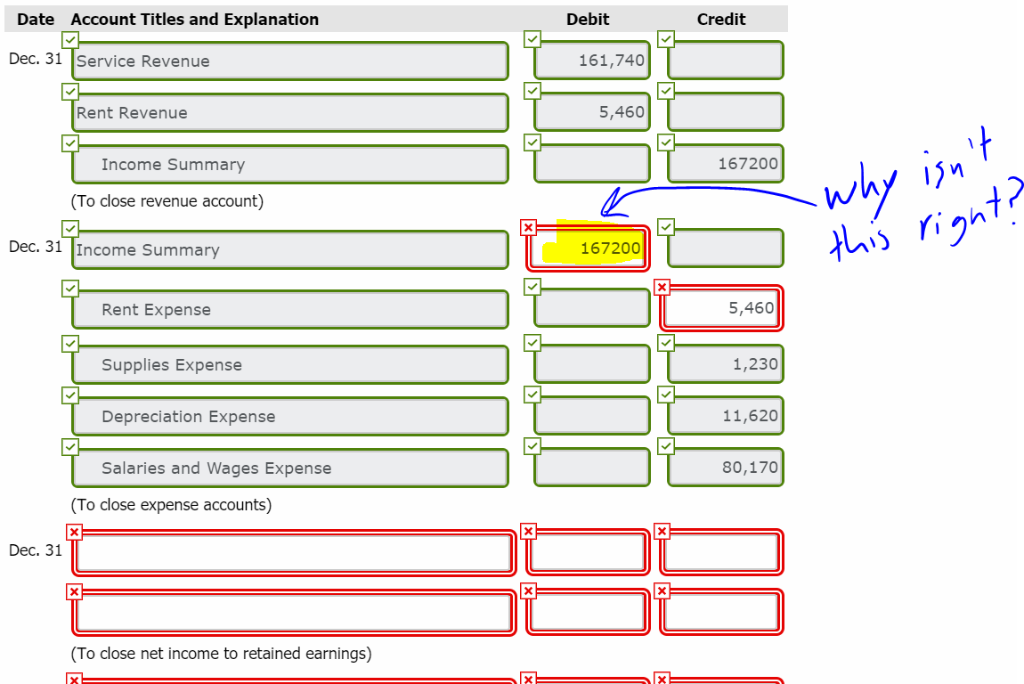

Indicate whether the event increases (+), decreases (-), or does not affect (NA) each element of the financial statements. Use a horizontal statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. (8) Recorded accrued salaries at the end of the accounting period. (7) Recognized expense for prepaid rent that had been used up by the end of the accounting period. (5) Paid in advance for two-year lease on office space. In parallel columns, list the accounts that would be debited and credited for each of the following unrelated transactions: (1) Acquired cash from the issue of common stock. (5) (6) (7) (8) Įxercise 3-4A Applying debit/credit terminology to accounting events LO 3-1 Required a. Recorded accrued salaries at the end of the accounting period. Recognized expense for prepaid rent that had been used up by the end of the accounting period. Paid in advance for two-year lease on office space. (4) Account Account Debited Credited Cash Service revenue X Salaries expense x Service revenue Accounts x Service revenue X receivable Operating X Cash expenses Cash X Common stock X Supplies x Accounts X payable Land x Cash X Dividends x Cash X Purchased supplies for cash. (1) Event Acquired cash from the issue of common stock. Required A Required B In parallel columns, list the accounts that would be debited and credited for each of the following unrelated transactions. Complete this question by entering your answers in the tabs below. > Answer is complete but not entirely correct. Also, in the Cash Flow column, use the letters OA to designate operating activity, IA for investing activity, and FA for financing activity.

Transcribed image text: Exercise 3-4A Applying debit/credit terminology to accounting events LO 3-1 Required a. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License.

We recommend using aĪuthors: Mitchell Franklin, Patty Graybeal, Dixon Cooperīook title: Principles of Accounting, Volume 1: Financial Accounting Use the information below to generate a citation. Then you must include on every digital page view the following attribution: If you are redistributing all or part of this book in a digital format, Then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a print format,

#Debit credit accounting exercises license

Want to cite, share, or modify this book? This book uses theĬreative Commons Attribution-NonCommercial-ShareAlike License business may only report activities on financial statements that are specifically related to company operations, not those activities that affect the owner personally period of time in which you performed the service or gave the customer the product is the period in which revenue is recognized system of using a monetary unit by which to value the transaction, such as the US dollar business must report any business activities that could affect what is reported on the financial statements (also referred to as the matching principle) matches expenses with associated revenues in the period in which the revenues were generated also known as the historical cost principle, states that everything the company owns or controls (assets) must be recorded at their value at the date of acquisition if uncertainty in a potential financial estimate, a company should err on the side of caution and report the most conservative amount

0 kommentar(er)

0 kommentar(er)